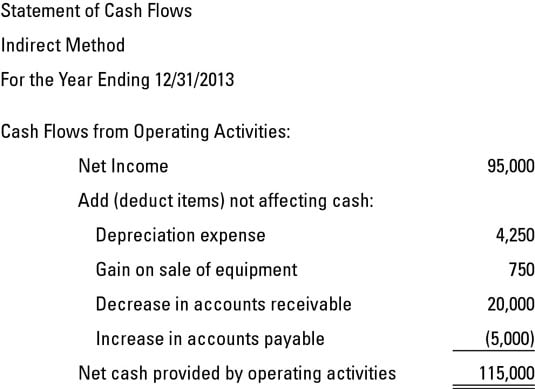

Decrease in Working Capital Liability → Cash Outflow (”Use”)įor instance, if OCF is much lower than net income due to rising accounts receivable (A/R) - i.e.Increase in Working Capital Liability → Cash Inflow (”Source”).Decrease in Working Capital Asset → Cash Inflow (”Source”).Increase in Working Capital Asset → Cash Outflow (”Use”).The relationship between changes in working capital items and their respective cash flow impacts are as follows: If OCF deviates substantially from net income, it implies further analysis is necessary to understand the underlying factors that are causing the difference. Operating Cash Flow (OCF) = Net Income + Depreciation & Amortization – Increase in NWC If we consolidate all the steps up to this point, we come up with the following formula: Once those adjustments have been made, the resulting line item is the “ Cash Flow from Operating Activities”, i.e.depreciation, amortization) and changes in net working capital (NWC). The CFO section converts the accrual-based net income metric by adjusting it for non-cash items (e.g.Then, other adjustments are made for the changes in working capital.The starting line item, net income (the “bottom line”), is first adjusted by adding back non-cash expenses (e.g.

the CFS’s top-line item is the accrual-based net income. Under the indirect method - the more common approach in the U.S. Operating Cash Flow Formula (Indirect Method) Direct Method – Instead of starting with net income, the direct method utilizes cash accounting to track the cash received from customers and paid out to third parties (e.g.D&A) and changes in working capital to arrive at cash flow from operations. Indirect Method: The beginning line item is net income, which is adjusted for non-cash items (e.g.The cash flow statement (CFS) can be presented under two methods - the indirect or the direct method: working capital and capital expenditures (CapEx).īut in the latter case with negative OCF, the company must seek external financing sources to meet its reinvestment spending needs, e.g. In a scenario with positive OCF, the company’s operations generate adequate cash to meet its reinvestment needs, e.g.

Indirect method cash flow formula how to#

How to Calculate Operating Cash Flow (Step-by-Step) Operating Cash Flow (OCF) measures the net cash generated from the core operations of a company within a specified time period.

0 kommentar(er)

0 kommentar(er)